Medicare Supplement Plan G

Our most popular plan. Medicare supplement insurance Plan G offers some of the most comprehensive benefits of all Medicare supplement plans, providing coverage for deductibles, coinsurance, and other out-of-pocket expenses.

Showing content for

Get a Medicare supplement Plan G quote

How Plan G works

Plan G provides benefits alongside Original Medicare to fill gaps and minimize your share of health care costs.

- Pays Part A hospital coinsurance

- Pays the Medicare Part A deductible ($1,736 in 2026)

- Covers Medicare Part B expenses after the deductible ($283 in 2026), plus any excess charges beyond the Medicare-approved amount.

- Gives you the freedom to choose any doctor, specialist or hospital that accepts Medicare anywhere in the U.S.

- Offers emergency care benefits outside of the U.S.¹

Medicare supplement Plan G benefits

See how Plan G coverage works to help lower your out-of-pocket expenses

| Yearly plan deductible | $0 |

| See any doctor, specialist or hospital that accepts Medicare in the U.S.? | Yes (no referrals needed) |

| Foreign travel emergency | You pay a $250 deductible, then 20% of remaining costs. (Plan pays 80%) |

| Part A deductible ($1,736 in 2026) | |

|---|---|

| Plan pays $1,736 | You pay $0 |

| Hospitalization - inpatient stays | |

Plan pays

|

You pay $0 |

| Hospitalization - extended coverage (Up to an additional 365 days in your lifetime after Medicare benefits are used) |

|

| Plan pays 100% of eligible expenses | You pay $0 |

| Skilled nursing facility care | |

Plan pays

|

You pay

|

| Home health care | |

| Plan pays $0 (Medicare pays 100%) | You pay $0 |

| Hospice care | |

| Plan pays any Medicare copays or coinsurance | You pay $0 |

| Blood | |

| Plan covers first 3 pints (Medicare covers the rest) | You pay $0 |

| Part B deductible ($283 in 2026) | |

|---|---|

| Plan pays $0 | You pay $283 |

| Part B excess charge | |

| Plan pays 100% | You pay $0 |

| Doctor's visits, emergency care and other medical services (Benefits after Part B deductible is met) |

|

| Plan pays generally 20% (Medicare coinsurance) | You pay $0 |

| Diagnostics laboratory tests | |

| Plan pays $0 (Medicare pays 100%) | You pay $0 |

| Durable medical equipment(Benefits after Part B deductible is met) | |

| Plan pays generally 20% (Medicare coinsurance) | You pay $0 |

| Home health care services | |

| Plan pays $0 (Medicare pays 100%) | You pay $0 |

| Blood (first 3 pints) | |

| Plan covers first 3 pints | You pay $0 |

Who is Medicare supplement Plan G best suited for?

Plan G can be a good choice if you’re looking for the peace of mind that comes from broad, reliable coverage

Medicare supplement Plan G eligibility

Frequently asked questions

Plan G is our most popular plan. It provides broad coverage which minimizes what you pay out-of-pocket.

Whether Plan G is the best Medicare supplement plan for you depends on your individual needs and preferences. If you need help deciding, try our Medicare Advice Center. We'll ask you a few questions about your preferences and then recommend the plan that fits you best.

BUNDLE

Dental Insurance

View coverage options for prices

Bundle dental insurance with your Medicare supplement insurance policy and you'll save 15% on your monthly dental insurance premium.

Simply add dental insurance when you apply online for Medicare supplement.

Choose how you’d like to apply for Plan G

We’re here to help – however you choose to apply

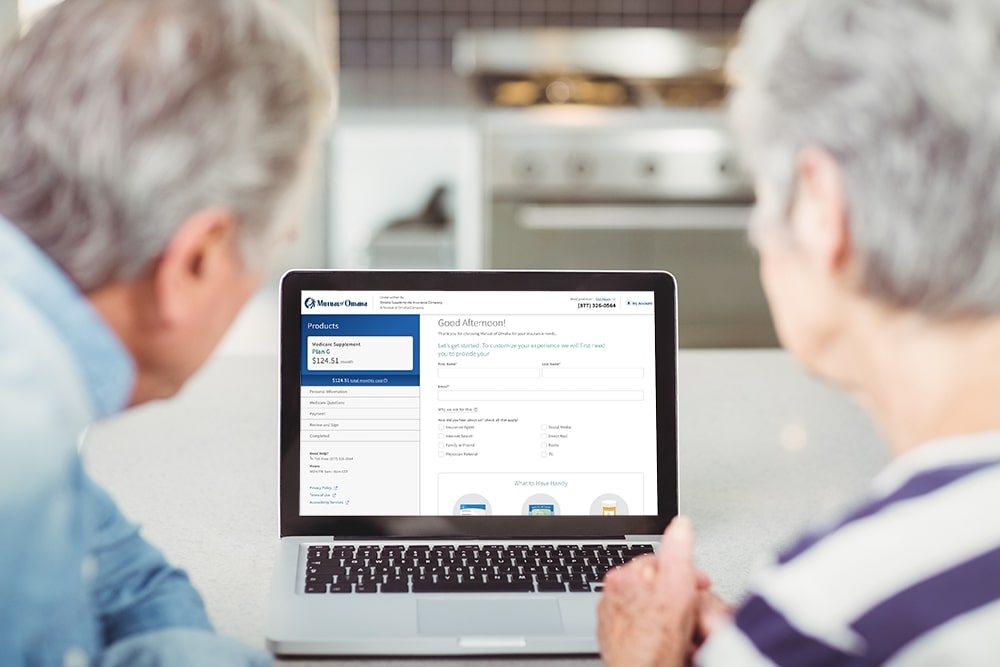

Apply online

Give us a call

Call toll-free 866-907-9302